Book review: The Prize - The Epic Quest for Oil, Money & Power

How oil created our modern world

Took me the better part of two months to get through this 789 page rat smasher. Was the payoff worth the toil? I’m inclined to say yes. To summarize in a sentence: The Prize tells the story of how oil became the world’s most valuable commodity and has enabled an unprecedented level of global development and wealth.

This was a hefty book and it’s going to be a long review, so grab a drink and get comfortable.

From a 50,000 foot perspective the most striking takeaway is that oil consumption and economic growth are inextricably linked. Gross negligence and misappropriation of resources aside, the countries that consume the most oil have the highest standard of living. When the flow of oil is disrupted, nations crumble.

It would appear that the West no longer understands that dynamic. We apparently (or a certain subset of our population) want to do away with fossil fuels while simultaneously maintaining our standard of living. This could work if we had an adequate replacement for oil, however, we do not at this time. Take California, an ambitious if mismanaged territory. America’s most prosperous state wants to ban the sale of gasoline cars, yet it’s also telling residents they can’t charge their EVs! See also Switzerland, which is joining the party. Unless we want to go back to a 1850s lifestyle (I would prefer not to) then we must replace oil, we cannot simply ban its use and call it a day.

Throughout the 20th century public institutions played an outsized role in the private oil market. Governments the world over have worked closely with, cajoled, sued, bailed out, supported, subsidized, nationalized, privatized and otherwise helped and hurt the big oil companies. Governments have tended to view oil not as just another commodity, but as an important part of national sovereignty. For example, access to oil played a key role in the outcome of World War II! Had a few petroleum related events played out differently, that global conflict against tyranny may have had a much more sinister conclusion. To read The Prize is to get a sense of how oil has shaped our world, for better or for worse.

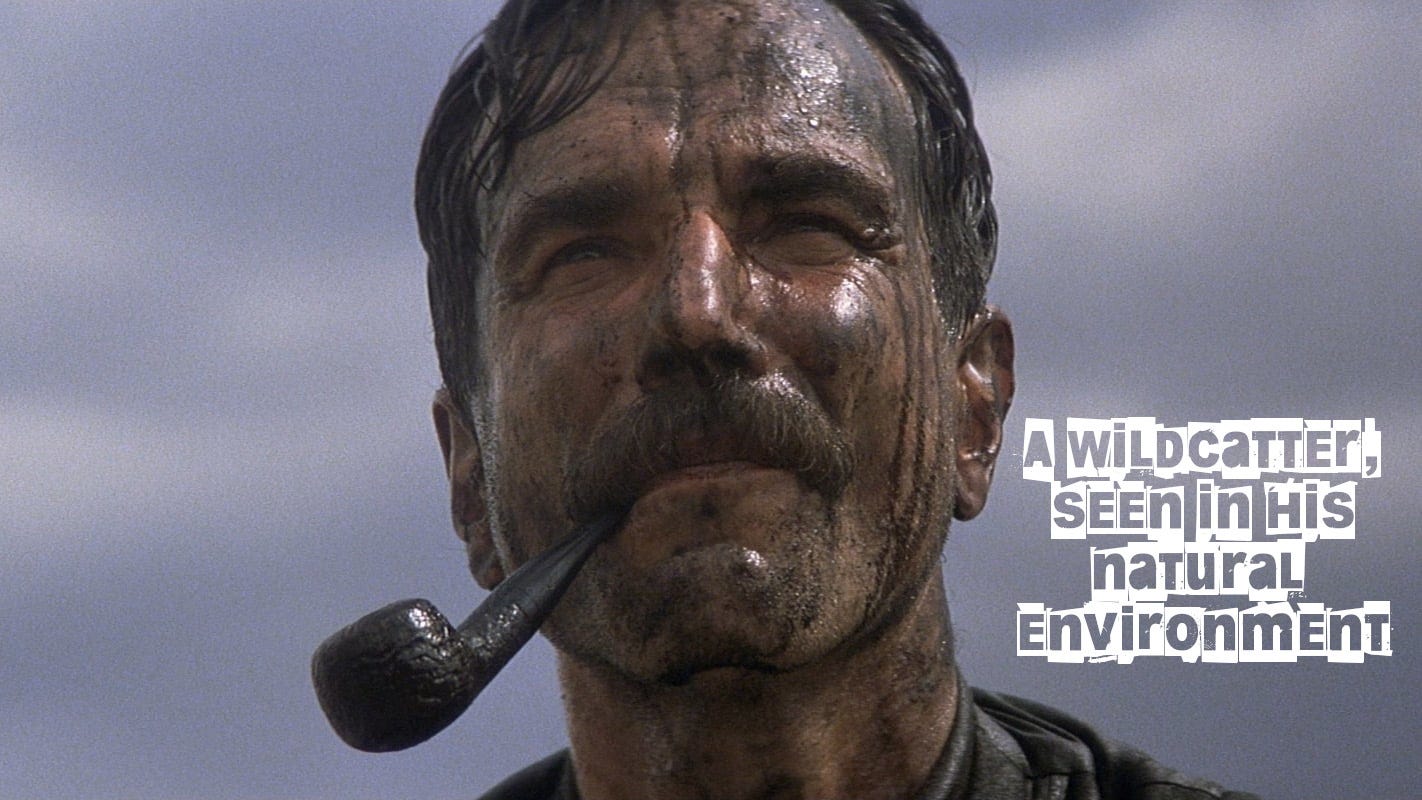

The wildcatters

One of the most enjoyable parts of reading The Prize was parsing the dozens of short stories about the men who dedicated their lives to the industry. Chief among them, the wildcatters. Oil-crazed individuals staking it all on the off chance of hitting a gusher. Some men became wealthy, others died destitute. A few even became quite wealthy and still managed to die destitute.

I saw how a person may have a talent for finding oil, but no skills at managing the business after the fact (see my review of Business Brilliant). Only rarely did the oil-drenched wildcatter end up on the yacht. Once the oil started flowing most of the money went to those who knew more about balance sheets, interest rates and politics, than geology and drilling rigs.

European crisis

The current energy crisis in Europe is not “unprecedented.” In fact, it’s eerily reminiscent of another crisis that happened (historically speaking) not that long ago. In 1956 Britain and France invaded Egypt because they didn’t like the political scene and wanted to take over the Suez canal. The invasion operation was poorly planned and executed, and after a week it was obvious that the Brits and the Frenchies had gotten themselves into a shitshow at the fuck factory.

Long story short Egypt’s dictator, a guy by the name of Nasser, sunk a few ships in the Suez thus blocking oil shipments from the middle east to Europe. Heading into winter the Europeans found themselves desperately short of oil, with only about a month of reserves to tide them over. Catastrophe was only averted when America put together a complex operation to increase domestic oil production and schlep over the excess to Europe. Thankfully the Europeans learned from that near miss and they never put themselves in a similar position again, right?

One of the less fortunate aspects of humanity that I’ve had to make peace with is that, broadly speaking, we don’t learn from our mistakes. Individuals certainly can, but something gets lost as you move from the individual to the collective. In 1956 Europe was overly reliant on middle eastern oil and when shipping was disrupted their countries would have been up shit’s creek if the States hadn’t been able to bail them out. You’d think there might be a lesson in there somewhere, but if there is it was forgotten long ago.

Windfall profits tax

Fifty years ago the oil majors were facing the same conundrum as today: market forces outside their control had pushed up the price of oil which was leading to newfound profits for the companies. Consumers were hurting though, and politicians started implementing windfall profits taxes.

My take on the situation is that the petroleum industry is perpetually in an unenviable political situation. When prices are not in the industry’s favor, nobody cares. A decade bear market in petroleum? Great for the consumer, let’s go! And sure, why not. However, as soon as the market changes and oil companies start making money they’re liable to come under political attack, even if the factors driving up the price of oil are outside of any one company’s control.

The problem with windfall taxes, of course, is that it’s likely to discourage new investment. High oil prices are a market signal saying we need more oil! Distorting that signal with taxes is probably a poor way to solve a long term structural supply side issues. I have no more insight to add than that, suffice to say that for an oil company to survive it must necessarily become skilled at the game of politik.

USA vs Europe

I learned that Europe’s natural gas partnership with Russia was first conceived in the early 80s. The United States was strongly opposed to Europe dealing with the Яusskies though, and threatened Europe with sanctions if they went ahead with their plans. Here’s a quote.

The Europeans wanted to use the gas [Soviet gas] as part of their energy diversification strategies and to reduce their dependence on oil. They also hoped to stimulate employment in the engineering and steel industries. The Reagan administration opposed the plan because they feared that the expanded imports would give the Soviets political leverage over Europe and they did not want to see the Russians gaining additional hard currency earnings, which would strengthen the Soviet economy and military machine.

I bring this up not because I want to point fingers at Europe and say you were warned, but rather as an illustration that the USA has opposed Russian energy exports to Europe for decades. The Nord Stream gas pipeline was recently blown up, an act which not only settled an old score, but has benefited America more than anyone else. Is any of this a coincidence? I’ll leave you to connect the pieces as you see fit.

A conspiracy?

Having just endorsed what’s probably viewed by many as a conspiratorial take on Nord Stream, I’m going to do a 180 and argue the other side. My goal in investing and in life is to view the world as objectively as possible.

Belief

Prejudice

Confirmation bias

Chuck all that bullshit out the window. Always asking, how am I wrong? What do I believe to be true that just ain’t so? Perfectly objective thinking is impossible, but it’s a beautiful ideal to aim for.

That being my mission I’d like to take this opportunity to illuminate my own bias. In selecting between the mainstream narrative and a conspiracy theory, I will *generally* be inclined to go with the conspiracy theory. Not without good reason! Often in the last few years the conspiracy theory has turned out to be a conspiracy fact. However, bias is bias and to keep my thinking sharp I must continually remind myself that some things just happen for random reasons. Here’s how this relates to oil.

In 1973 Egypt and Syria teemed up to inflict a series of brutal attacks on an unprepared Israel. The Yom Kippur offensive was so effective that within a week it was clear that Israel might go under if the army didn’t get fresh supplies. The United States wanted to help but was petrified of pissing off the Middle East oil producers, upon whom America had come to rely. A plan was hatched. Under the cover of darkness the US would discreetly send a sortie of supplies to Israel in what would become known as Operation Nickel Grass.

Unable to reach that far away country in one go, the pilots would refuel in Portugal then depart at such a time as to land in Israel in the dead of night. The planes would be in and out in total darkness and the oil-rich Arabs would be none the wiser.

Unfortunately, heavy winds in Portugal set the plan back by six hours. By the time it was all said and done, the planes ended up arriving in Israel in broad daylight, stars and stripes painted on the fuselage for all to see. America’s support of Israel was a front page story the world over, and the Arab oil producers were outraged.

If this happened today I can already picture the ZeroHedge headline: American government makes a statement: we support Israel! The conspiracy theorists would have a field day, trying to figure out why the President wanted to make a huge public display of supporting a fledgling state. However, none of that discussion would be correct. The real headline would be: United States government tries to covertly support Israel but the stupid fucking wind ruined the schedule.

Some things are a conspiracy, and some things are not. The world is a big place and there’s plenty of room for randomness to affect the outcome.

Final remarks

Titan, John D. Rockefeller’s biography, is another long book about oil. Of the two tomes I prefer The Prize. I learned more, the stories were more interesting. I have an appreciation and understanding of oil that I never would have achieved if I hadn’t picked my way through these pages.

Humanity’s rise out of the mire of poverty is inextricably linked to the consumption of oil. Ten thousand fortunes were made and lost in the great petroleum race before you and I were even born. At the end of Dune, Paul Atreides consummates himself master of the solar system because he who controls the spice, controls the universe. In this day and age the mantra is: he who controls the oil, controls the economy. Until we find a sustainable way to wean ourselves off liquefied dinosaur bones, we’re stuck with this stuff we call petroleum. Plan accordingly.

More like liquified alge fermented, with some slivers ilof diansour bones mixed in.

If you liked The Prize book, check out the ~8 hour documentary available on YouTube