I’ve crunched the numbers and come to the conclusion that there are exactly 349,489 unique trading and investing styles that you can make money with. The difficulty is that 349,488 of them just aren’t going to work for me.

To enjoy long term success I must find a style that suits me, and that I can stick with for years (decades) at a time. I reserve the right to change my mind at any time, and I won’t be dogmatic in my approach. However, as of now this is what I think could work for me.

A unique time frame

Day trading is out. I have zero interest in that malarkey and also I’m living in Asia and going to bed an hour or two after markets open. Swing trading, breakout trading and momentum trading are non-starters as well. Mostly because I don’t know what they are.

My time frame skews towards long term investing. I am comfortable sitting on an asset for months or years, and I’m undisturbed by volatility. If I have one edge in the markets, it’s my ability to stay calm in the face of huge drawdowns.

While I lean towards the long term time frame, the primary aspect of investing that I don’t embrace is the idea that I *must* hold a position for years at a time. In an ideal world my investment strategy would look something like,

Allocate 5 to 15% of my AUM to an asset which I hope will appreciate in the near future

Take profits on rips up

If the rip never comes (which is likely) I will hold the asset until it starts to perform, even if it takes a year or two

Even as I write these words my strategy sounds stupid. Maybe I should reframe it as: I invest for the long term but if there is a short term rip, I take profits. The key point, the foundation of my approach, is that I’m only investing in assets that I’m comfortable holding for years. I can’t see myself having a sizeable position in an asset which I think could do well in the short term, but is ultimately garbage.

I expect that over time my strategy will change. However, for now, the major advantage is that investing in quality plays to my number one goal: don’t blow up.

What I don’t want

By explicitly stating what I don’t care about, I hope to reduce feelings of fomo and regret. By consciously deciding that I’ll never invest in promising opportunities like Bubble Gum Dildo Corp, I won’t have to feel bad when “everyone” is up 150% and my position in long bonds is down 3%. Off the top of my head, here is everything that I don’t want to invest in…

Day trading

FX

Tech (although I am intrigued by semiconductors)

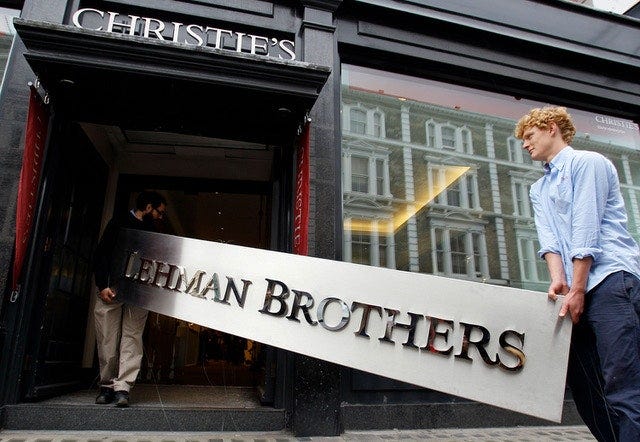

Financials

Asian markets (except for possibly Asian commodity producers)

China (I’m not a big fan of slave labor)

Healthcare

Food

Shipping (possible exception for tankers?)

Automotive companies

Airlines

Robotics

REITs

Media

Consumer staples

NFTs

Defense

Venture capital

Meme stocks

Retailers

Housing

Natgas

Anything promoted by Adam Neumann

What I like

Bitcoin and Ethereum

Commodities & commodity producers

Gold

Bonds

Even though this list is short, in terms of scope it’s still massive! Many traders/investors only focus on one of these markets. Over time I may specialize further.

Summation

Intention: make explicit statement about everything I will IGNORE. Reduce fomo, simplify process of immediately chucking 99 out of 100 trade ideas into the bin of inviability.