Has winter arrived for the oil market?

Thoughts on oil and making the right decision amidst uncertainty

I’m writing from a guesthouse in an undisclosed location in Asia. This weekend I’m taking a free diving course and I expect that by Sunday evening I’ll have dove to 60 feet on a single breath. My previous record is about 30 feet, without fins or training. At 30 feet the ocean is quiet and slightly dim. The surface appears as an oasis in the desert. Free diving enforces serenity since panicking can lead to negative outcomes, like a cessation of aliveness.

I’m not panicking about my position in oil, however, it would appear that there’s a decent chance that the next big move will be down. In light of the fact that oil could be about to tank, I’m reducing my oil equities exposure from 7% to 5%. I’ve gone down to 5% because that’s a number I’m comfortable holding through massive volatility. Down 30% by October? No problem.

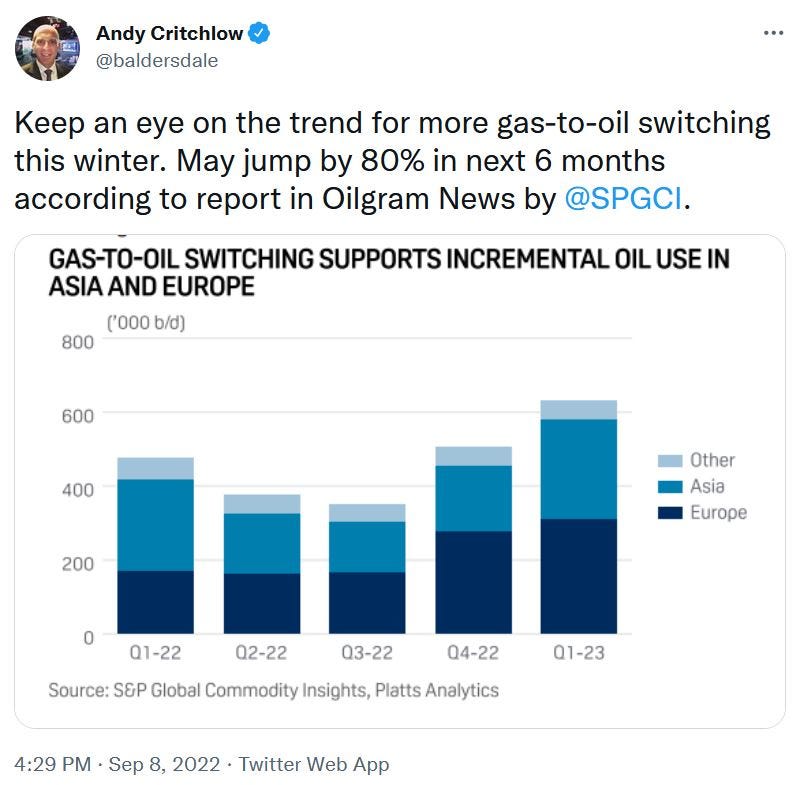

Is a big oil crash my base case? The truth is, I don’t know. On our current trajectory, it appears like global recession narrative is winning out over the fuel-switching narrative. Death match! Two narratives enter the octagon, only one steps out…

Nobody can predict the future. Fuel switching or not, a key piece of my oil position is a bet that something, somewhere, might go wrong.

Iraqi oil goes offline

Hurricane takes infrastructure offline in USA

A pipeline gets destroyed

A tanker going to Russia runs aground and the Russian insurance scheme is forced to pay out billions. All crude shipments from Russian are halted indefinitely as the country’s financial situation comes into question

SPR release ends and puts upwards pressure on price

Financial system breaks somewhere, central banks have to start printing and WTI goes to $120

Alien invaders destroy all the offshore drilling rigs. I mean, seriously, why not? After the last three years you’re saying this is unreasonable?

I’m not hoping for any of these negative events, however, if they’re going to happen anyways well why not profit? Essentially, my oil position is an insurance policy. If nothing happens, I will likely lose money (in the short to medium term). If the oil market ends up FUBAR, I’ll make money.

Breaking out of the Matrix

I love to write. That’s the primary reason I started this Substack. The second reason is that I want a public forum to hold me accountable. For example, I found it embarrassing to write the post The worst two trades I’ve made this year.

I published that article because, even if I don’t know who reads it, the fact that someone reads my rantings keeps me accountable for my actions. I’ve made a deal with myself: every time I do something idiotic I have to write about it for the world to see. Since I don’t enjoy doing that, the easiest solution is to just not do stupid shit.

Survive. Reduce my oil exposure so I can live through the bear.

The sonnet inspiring heart of this Substack is that I’m someone who went irresponsibly long crypto for 5 years and made a chunk of change. Now I want to grow that capital with a good balance between risk and reward. I want to be in the game fifty years from now. Fuck meme stocks, yoloing calls on Robin Hood, and yes BTC is cool but no the US government is not, I guarantee-fucking-promise you, going to adopt a Bitcoin standard.

Circling back to crude, is it possible that I’m the world’s biggest chump and I’m bottom ticking the market as I reduce my oil exposure? Yeah! Oh fuck yeah. Is negative market sentiment making me act the fool? I wrestle with these questions deeply. The most important theme in my life is how to think for myself… Sometimes I’ll get it wrong, but I hope that over time I’ll figure out how to do it better.