Green shoots across the board. When I look at the 25 or 30 stocks, commodities, currencies, bonds and ETFs that I have loaded in Trading View, I can’t find anything that hasn’t rallied in the last 24 hours. So, is that it? The bear market is cancelled and it’s Lamborghinis and Peruvian marching powder from here on out? My guess is no. Here’s why…

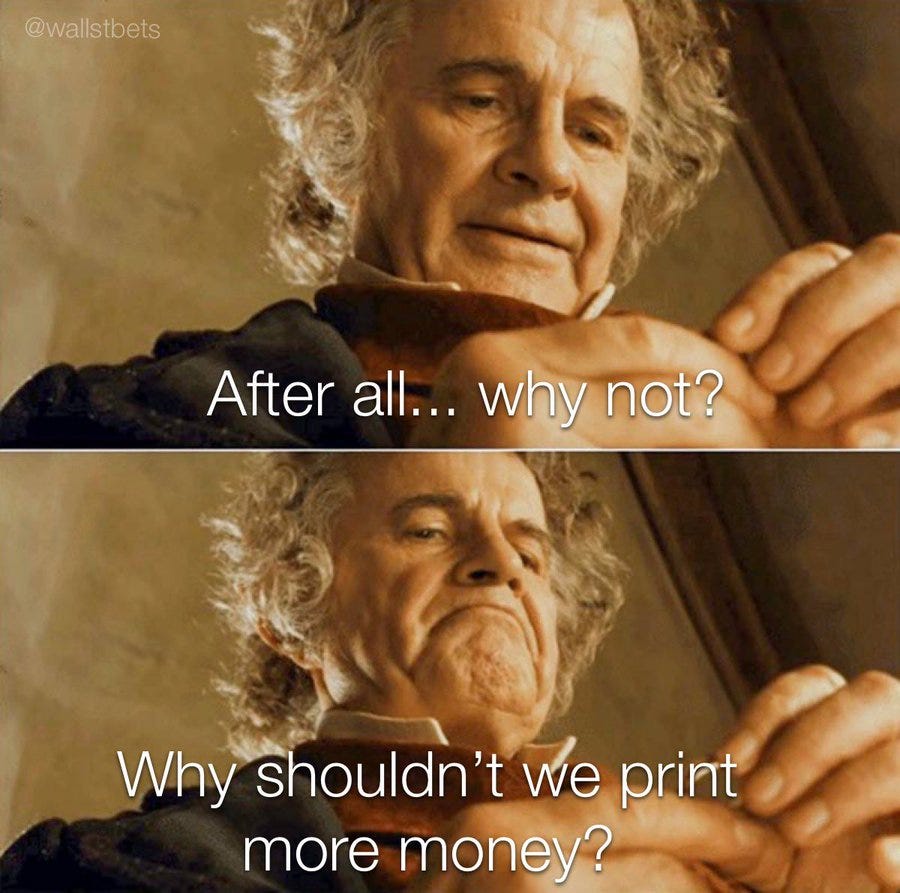

To the extent that we ever know why the market does anything, the BOE restarting QE appears to be the reason for rally. The magic money printer is back, the markets rejoice and even the meme stocks catch a bid. The markets are acting as though the BOE pivot means the Fed pivot is just around the corner.

While I do believe that the Fed will pivot sometime in the next three to six months, I don’t think it’s going to happen tomorrow or next week. So let’s make the relatively safe assumption that the Fed won’t pivot in the next 45 days, where does that leave us?

Bull case

BOE is going to inject more liquidity in the system

Bear case

BOE is going to inject more liquidity in the system because their pension funds are getting margin called and they’re in the early stages of an energy crisis. Also, their currency is fucked and will presumably get fuckeder once the printing press warms up

Nord Stream pipeline sabotage (how wild is that, we get to use the word sabotage - I feel like we’re living in 1946) means that there’s no incentive for peace. Any small glimmer of hope that Europe might deescalate with Russia is off the table. There will be no gas coming to the rescue

QT from the Fed is ongoing, as are the rate hikes

This bullish 24 hours may just be funds pumping up assets to juice their shitty Q3 numbers

Global recession impending

Highly restrictive interest rates

Japanese Yen, English Pound and Chinese Yuan plummeting

Jim Cramer says the bottom is already in

The scam pump

I follow a technical analyst on Twitter who loves to use the phrase scam pump. I think that’s an appropriate description of what’s happening right now. If you’re going to argue that the bottom is in, and we’re going higher from here, you’ll also have to argue why that should happen. When I look out over the bleak macro landscape, I can’t find any good reason why the bear has ended.

In my unprofessional opinion, I think we’re about to experience a bloodbath. Sometime within the next month, a good ‘ol fashioned cliff dive. Proper fear, real capitulation, sentiment so disgusting that people start crying and panic selling. While I am intrigued by this small pump, I’m highly unconvinced that it has cancelled the horror show to come.

What I’m doing with my money

I’m about 70% certain of my scam pump thesis. As such, I’m still largely in cash. However, I’m still proudly holding my now underwater investment in oil and bonds. I’ve sized these positions so that I can endure volatility, and I have faith that they’ll do well within the next year.

Despite my bearish outlook, I’ve been slowly averaging into some gold and silver miners. Impending bloodbath or no, these stocks are already looking cheap and I think now is good opportunity to take an initial (small) position.