I’ve started dollar-cost-averaging into Newmont. This well-known gold miner has a good reputation and a cool name. The stock is down 51% from its local highs in April, which suggests that this could be a reasonable buying opportunity. There are a lot of negative factors driving down the share price right now.

Multi-decade high dollar has resulted in a massive sell off in gold

Decade high interest rates has further hurt gold

High energy costs are also a negative factor, although I don’t know the extent to which this is a factor in Newmont’s valuation

Gareth made a great point in this interview; inflation is hitting gold miners as they must pay more for labor and materials

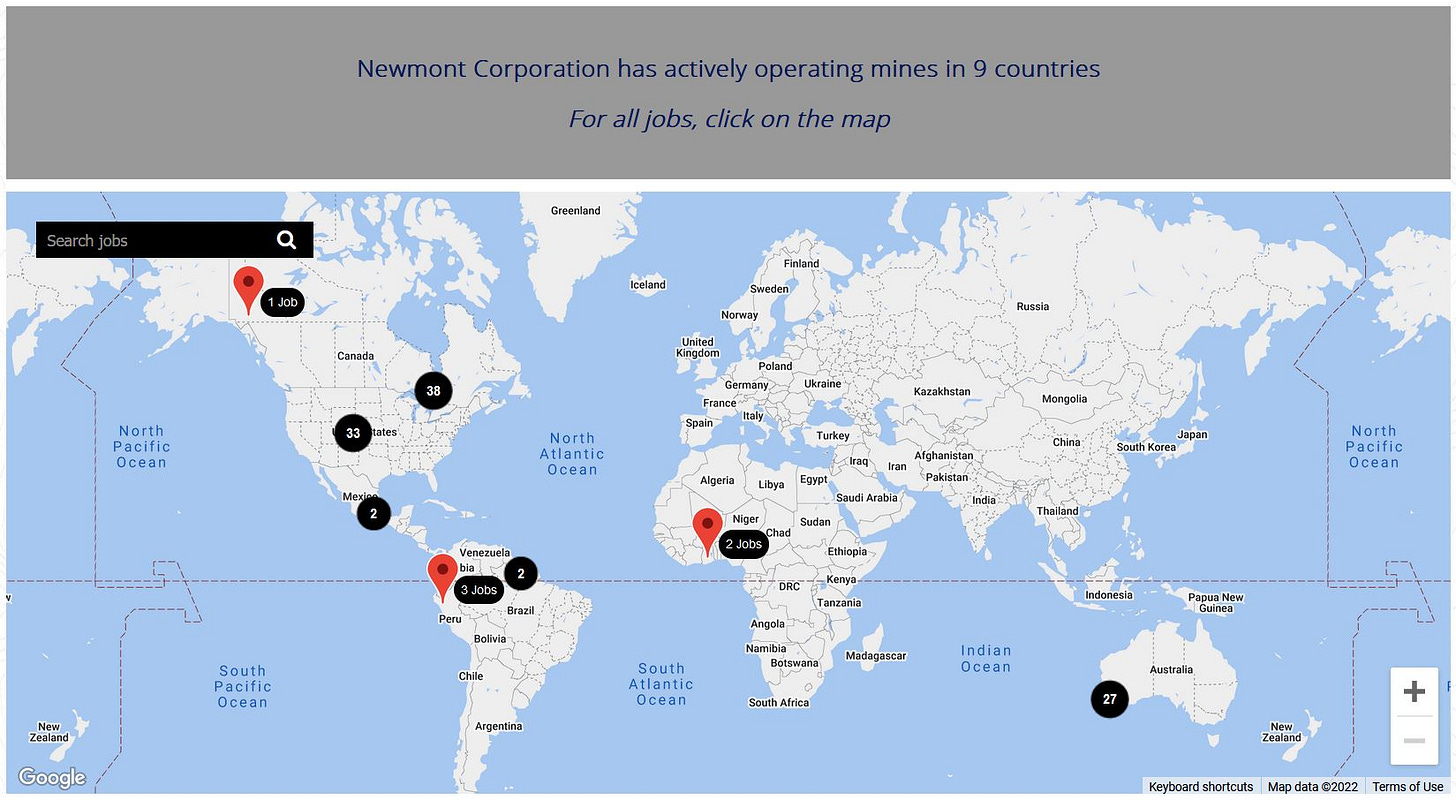

I have a core thesis that the Fed is going to pivot within the next 12 months. I expect QE within 18 months at the most. I think the energy crisis will eventually get solved (although Newmont doesn’t have any European mines), and inflation will not remain this elevated. In short, I expect that two years from now the conditions for Newmont, and gold in general, will be far more favorable.

My average buy price on NEM is $42. Could we go a lot lower? Sure! But who knows, maybe we don’t? I can’t pick a bottom so I’m slowly buying in. If the stock craters, I’ll buy even more. Since I find it unlikely that this will be a short term trade, and could take a year or two to show profits, I only want to put 2 to 3% of my assets into Newmont.