What I’m thinking about

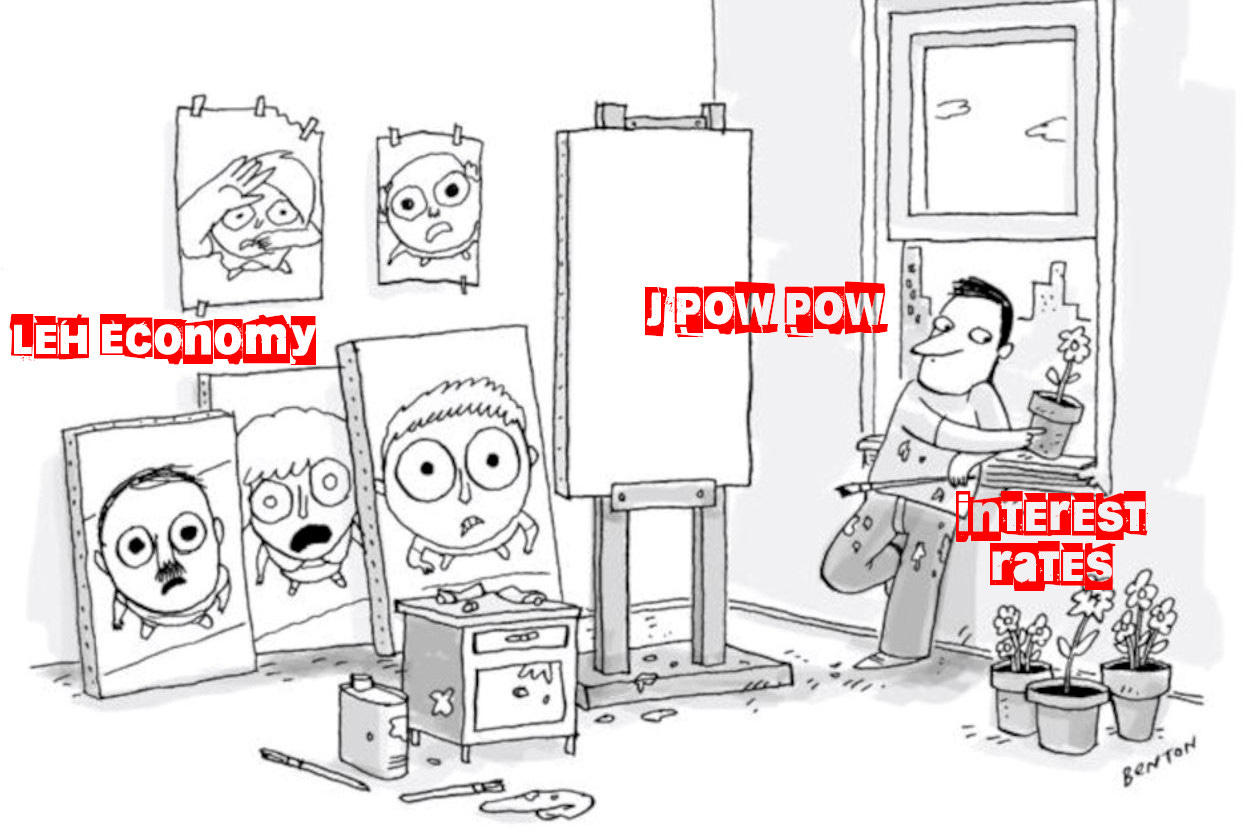

I have no idea what’s driving asset valuations right now. Short squeezes, delta hedging, lack of liquidity, Japanese Yen melting down, new highs in interest rates, what have you. Mayhem everywhere. For me this is a time of waiting. Reading my book and enjoying life. I still expect a crash at some point, proper capitulation, but until that happens I’ll just keep learning something new every day.

Best of articles

We Will See the Return of Capital Investment on a Massive Scale

Theme: Russel Napier lays out his case for financial repression, and government mandated spending in approved sectors. I.e. governments telling corporate banks to lend into certain sectors and guaranteeing these loans. Interesting take. Certainly if we do see this happen it would make the case for investing in those sectors that the government is backing.

Theme: Kuppy is back to writing a weekly article, lucky for us. In this article Kuppy ponders a blowout in the 30 year to 10% and whether markets might crash even after the Fed pivots. Ultimately, it’s unknowable. The art of investing is the art of dealing with uncertainty.

A Brief History of the Past 10,000 Years of Monetary Policy and Why Last Week Was a Big Deal

Theme: A fun, and exceedingly thorough, examination of what the hell went wrong with the tea drinkers’ pension fund.

Theme: I really enjoy Erik Torenberg, he seems to have a better understanding of society’s quagmires than just about anyone. This was an excellent article, especially in its explanation of how the current thing is not about rationality, and cannot be defeated with logic.

Theme: I’m not going to make a habit out of recommending Tweet threads, but this one can’t be ignored. A sober, well-thought out analysis on how the US government will respond if yields keep rising. Given the state of the bond market right now, this information is incredibly pertinent.

Theme: Another great article from The Last Bear Standing. This week’s treatise focuses on America’s exorbitant privilege in regard to dollar printing, which benefits the US but hurts all the other countries holding dollars and dollar denominated assets (treasuries).

Best of YouTube

Fed Sacrificing Markets & Global Economy In Crusade To Kill Inflation

Theme: Danielle is gold. A look at the economy, central bank policy, what’s going wrong with the world.

QTR #297 - Larry Lepard

Theme: Interesting take on a potential sovereign debt crisis, role that gold plays, preparing for the crash, etc. Lepard strikes me as someone who has his head screwed on straight, even if I don’t agree that we’ll see a $2 million BTC anytime in the next five years.

Banks Are Finally Making Money Again | Chris Whalen

Theme: Chris Whalen is another economic gangster. There’s more information and wisdom in this one hour than in 1,000 hours of CNBC. If you have the slightest interest in how the banking system works, how banks make money, which banks are riskiest and which will be OK, and how interest rates affect bank profitability, this is a banger of an episode.

Fred Hickey on Gold, Tech Stocks, and the Everything Bubble

Theme: A sober analysis of the market, especially tech stocks. Historical look at how prior bubbles broke. Bullish views on gold. 80% of the value comes from the first hour.

The world rocked by Euro$ collateral; Italy, Eurobonds, maybe the '22 equivalent of "toxic waste."

Theme: Jeff, the master of the Eurodollar. All about collateral in the system.

Rising Interest Rates To "Break Something", But Also To Result In Good Values

Theme: Dylan Grice doesn’t give a lot of interviews so this was a unique chance to learn what he’s thinking about. Primary topic for the conversation is Dylan admitting that he cannot predict markets, but wants to design a portfolio that will work no matter what the unforeseeable future provides. Excellent interview.

Thank you for your recommendations.