Working with a wealthy New Yorker changed my life

A treatise on beliefs about wealth; do you think $50 is a lot of money?

I grew up in a two stoplight town boxed in by cornfields. All things considered I was incredibly lucky. My father always had a copy of the New Yorker laying around and he encouraged me to read it. My mother took us all over the country so that by the time I was a teenager I had visited more states than I had years in my age. Despite my broadened horizons, as a young man I still found myself limited in one key regard: my beliefs about money. In my household, and indeed in almost every household I knew, $50 was a lot of money.

The trouble is that if you believe $50 is a lot of money, you’re living in a scarcity mindset*. You most likely have limiting beliefs about money, about what “a lot” of money is and about how much wealth you could accumulate. Find a person who believes $50 is a lot and ask them, “do you think you could be a millionaire?” I would expect that most would answer no, as if the question is silly.

*Rereading this paragraph I realize that I may come off as insensitive and out of touch. People believe $50 is a lot of money because it is you elitist fucknut. Fair enough, however, two points. One: as I wrote in my first post, at my lowest monetary point I had no money and couldn’t eat for 36 hours. I’m not a trust fund anthropologist studying the poors for amusement. Two: this post is about creating a new mindset so that hopefully we can achieve better views about wealth so that $50 doesn’t have to be a lot of money.

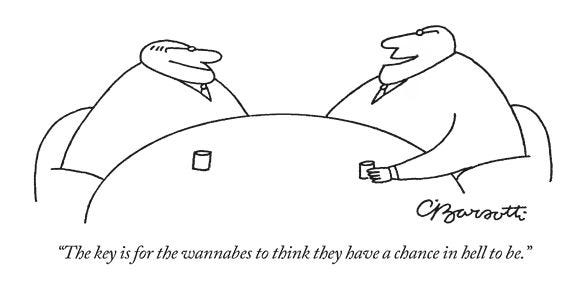

I stopped believing $50 was a lot of money when I moved to New York City and took a job working with a wealthy financier. Said financier was in his 50s and despite having everything that money could buy, his life was without purpose. Banging models and driving his Porsche to the Hamptons every weekend sustained him through his forties, however, after a decade of debauchery the thrills were wearing thin. Childless, hobbyless, he was a pulsating caricature of the unfilled rich person.

Instead of taking up golf or getting involved in philanthropy, he chose to create a “startup.” Mr. Financier hired a few people, yours truly included, and we all started working on a product.

Within two months it was clear that the whole thing was a hot mess with a zero percent chance of success. The idea was mediocre, the execution was dead on arrival and subconsciously the guy didn’t ever want to ship since that would set him up for failure (if you never ship you can’t have your heart broken). The entire enterprise was the most magnificent bonfire of wealth I’ve ever seen. I look back on it fondly.

That changed my life

Despite the “startup” being a doomed charade, it afforded me the opportunity to spend hundreds of hours in close contact with an absurdly wealthy human being.

I observed as he ordered off the menu without looking at prices, dropped hundreds of dollars at Whole Foods without noticing the register’s tally and moved from an already amazing $10,000 a month apartment in Tribeca, to a $15,000 a month SoHo loft ripped straight out of The Devil Wears Prada. Can you say 20 foot ceilings?

Without consciously realizing what was happening, I began to appreciate that $50 is not a lot of cash. My limiting beliefs about the scarcity of money could not survive the influence of his abundance lifestyle. To that point in my life I had never met someone who never worried about money. For all intents and purposes there was nothing he couldn’t afford, and the way he interacted with the world inculcated in me a new way of understanding wealth.

I moved to New York with a restricted view of how much I deserved, or could one day have. I exited New York with a new appreciation for what’s possible. Things that I believe now, that I didn’t believe when I was 18…

I believe that I can become a millionaire.

I can see myself as the type of person who has a seven digit bank account.

I believe in the abundance of money.

What do you believe? I don’t have amazing advice to offer or any magic pill that can fix your thinking. However, if you are of humble origins, like your dear narrator, and are still carrying those limiting monetary beliefs with you, best to lose them now.

Find a way to challenge your perception of wealth, and how you view your odds of success. If you believe $50 is a lot of money, you’re probably not going to make it in the big leagues. Our expectations shape our reality and if you can’t imagine yourself living a certain lifestyle, it’s so much less likely you’ll manifest the good life.

Key takeaway

After going through this article I’m not sure that I’ve added value to your life, dear reader. The Unhedged Capitalist worked for a rich bloke and learned some abstract lesson about money. Something to do with fifty dollars? Cool story, bro.

Fair enough, I may not have done a good job expressing myself.

Here’s the concentrated heart of the matter: If you grew up in a working or middle class household, it is likely that to a greater or lesser extent you’ve internalized beliefs about money that may hinder your pursuit of wealth. The point I’m trying to make with the $50 is that to gain real wealth you must shift your mindset. Instead of treating $50 like a lot of money, you need to enter a new reality where $1 million is not a lot! Expand your range of possibilities, don’t get held back by limiting beliefs.

Epilogue

I’d like to add, this financier was a very nice and unusually generous man. Misguided as he was, I consider him a good person. I wish him the best, and can only wonder what kind of amazing apartment he’s living in now.

Every Sunday I publish a recap of all the best finance articles and podcast episodes I’ve found thought-provoking. Here’s the latest edition.

If you’d like to get this free newsletter straight to your inbox just enter your email below 👇

I think it is a very good piece and your intention comes across loud and clear. Two thoughts:

1. Money is energy and how much of it we can use and process depends entirely on how expansive or constrained our wordview is. Our education system teaches us to think only inside a very tighy defined box and that the world outside it is terrifying (and the answers are in the back). Your $50 can only ever be evaluated in terms of the total energy required to achieve the intentional potential of the user. For some it is everything, for others an irrelevance.

2. Please read Lewis Schiff’s Business Brilliant for the best understanding of how middle class psychology stands squarely in the way of a prosperity mindset. It is probably the best work on the subject. If you enjoy it and want to know more I can introduce you to Lewis next time I am in NY (if that is where you still reside). Good piece though.