Sure as crappy pizza at the airport or Elon Musk getting away with stupid shit that would end a lesser mortal’s career, at some point the Fed must pivot. The rate hikes need to cease existing and if rates don’t fall enough on their own, the Fed will almost certainly have to manufacture some QE to drive them lower. It all comes down to sovereign debt.

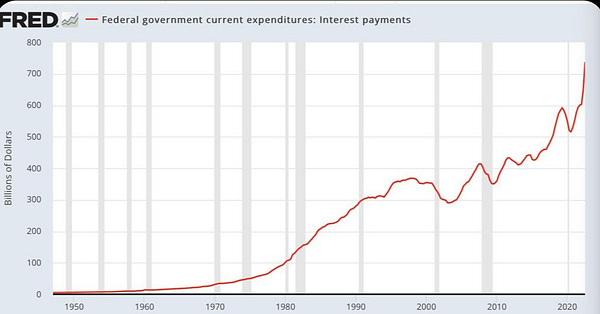

The United States is an indebted nation. Not that anyone is counting anymore, but if you have a taste for numbers we’re about $31 trillion in the hole. Or, $93,800 per man, woman and child. No biggie when rates are close to 0%, but it really starts to add up once rates are at 4%. In fact, we’re approaching $1 trillion in annual interest payments. Kinda sounds like a lot, doesn’t it? That would be about triple the $378 billion we spent on interest in 2021.

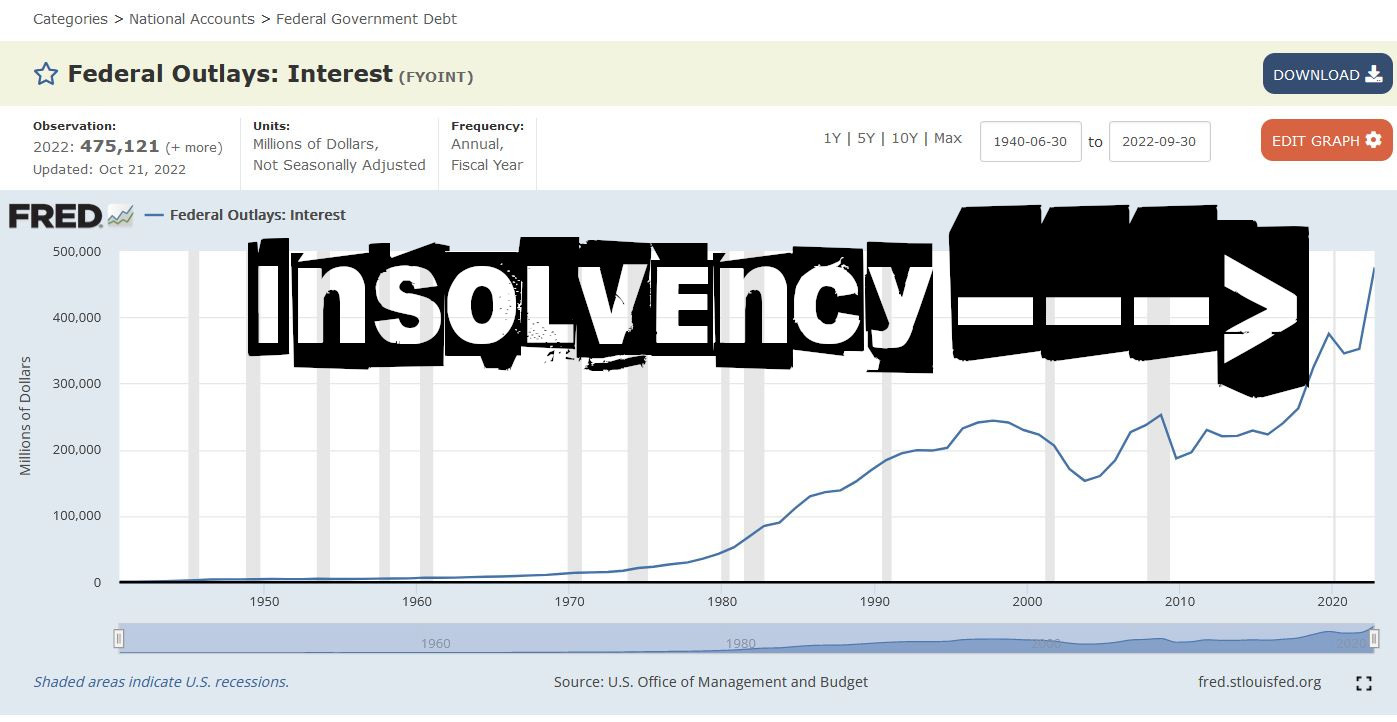

If interest rates remain at these levels, we’re eventually going to be borrowing hundreds of billions of dollars per year just to make interest payments on the existing debt. That’s a fast and sure road to insolvency. Rest assured, I don’t think we’ll reach that point. Why would we, when the Fed can pivot and if need be, restart the magic money printer. All this talk about inflation, forget it. Zoom out, look at the bigger picture.

A) Death spiral of interest payments until America is insolvent

B) Print the money

I’d put my money on B, but to be honest my opinion is worth a box of bugs. For an expert’s take let’s turn to Michael Howell, a man who has forgotten more about the markets than I’ve ever learned. Here are a few choice excerpts from his recent appearance on Real Vision.

“The US does not cover its interest bill using tax revenues minus mandatory spending plus defense. That’s a very worrying statistic, but, as I say ,it’s going to get worse. The congressional budget office predicts that in the next five years that that 0.8 ratio will go to 0.6. And it projects that it goes, in the following five years, to about 0.25. So the US is going to have to start borrowing aggressively, just to cover its interest rate bill.”

“There’s another shoe to drop as well. If you look at those congressional budget office estimates, they project that the average interest rate on the debt that the US is taking up is 2.1%. Good luck there, because as you know yields are now up over 4%. So in other words, that interest rate bill is going to double and that’s a very worrying figure. Therefore, the conclusion has got to be that to avoid yields going up, central banks are going to have to come back with QE. All this talk about continued QT, you know, it’s pie in the sky. It’s not going to happen. It creates illiquidity in financial markets, and what’s more, they need central banks to buy more and more of this treasury paper.”

Preach it Michael. The United States cannot afford to keep interest rates at these levels indefinitely, let alone higher rates. While the Fed can enjoy their moment of larping, I believe that interest rates will have to come down no matter what the consequences on inflation.

As I wrote last month, I expect a Fed pivot within the next three to six months. That’s based on something (besides FTX) blowing up in the markets. Even without a blowout though, I still think there will have to be a pivot within 6 to 18 months, and a return to lower rates. We are not in a place as a society to live with higher rates for longer.

Have you played out option C?

C. Inflate away government debt? It's been successfully used previously.